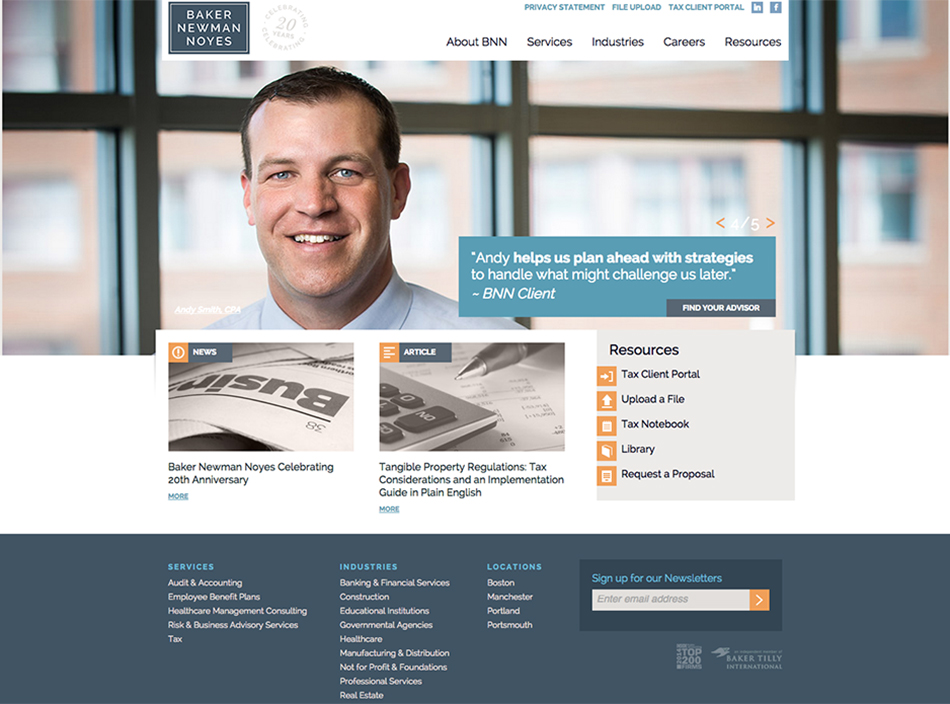

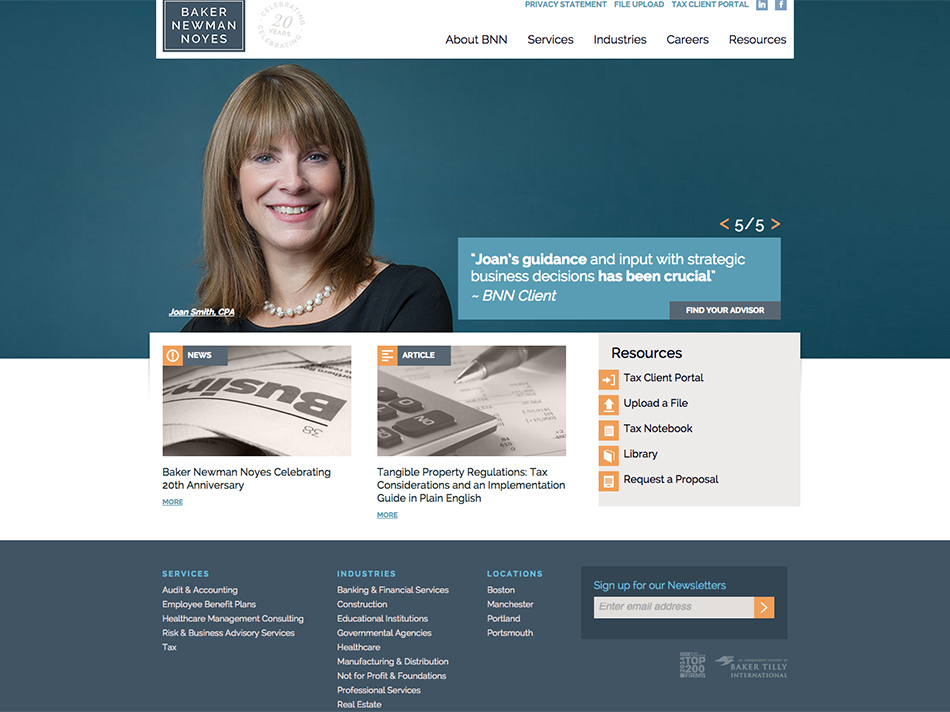

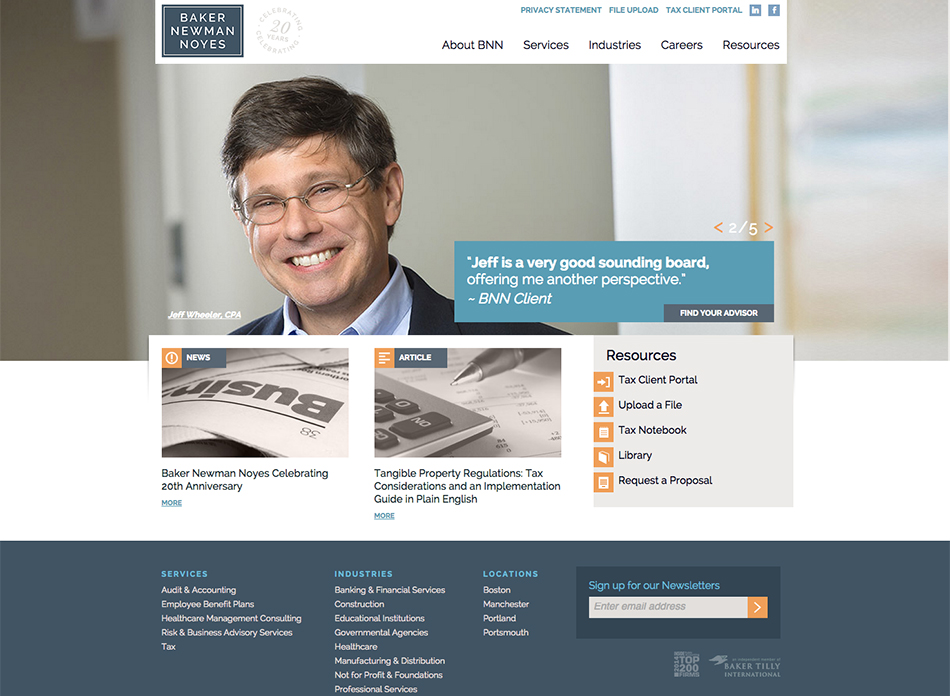

I’ve worked with the fine folks at BNN, a full-service accounting firm based in Portland, ME, for a few years now. In honor of their 20th anniversary, they just relaunched their refreshed website look this week with a new logo and a few of the environmental portraits we’ve done featuring their principals within their beautiful downtown Portland office space. They wanted to emphasize the personal, human component of their services, and I think the new web design and images work well to do that.